are hoa fees tax deductible in nj

Tax Tips for New Jersey HOAs and Condo Associations. It does this with the help of HOA dues fees that the association collects from members.

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

The Cooperative Recording Act of New Jersey applies to cooperatives in the state.

. You can find the Cooperative Recording Act of New Jersey under Chapter 468D of the New Jersey Revised Statutes. Generally HOA dues are not tax deductible if you use your property as a home year-round. 6 to 30 characters long.

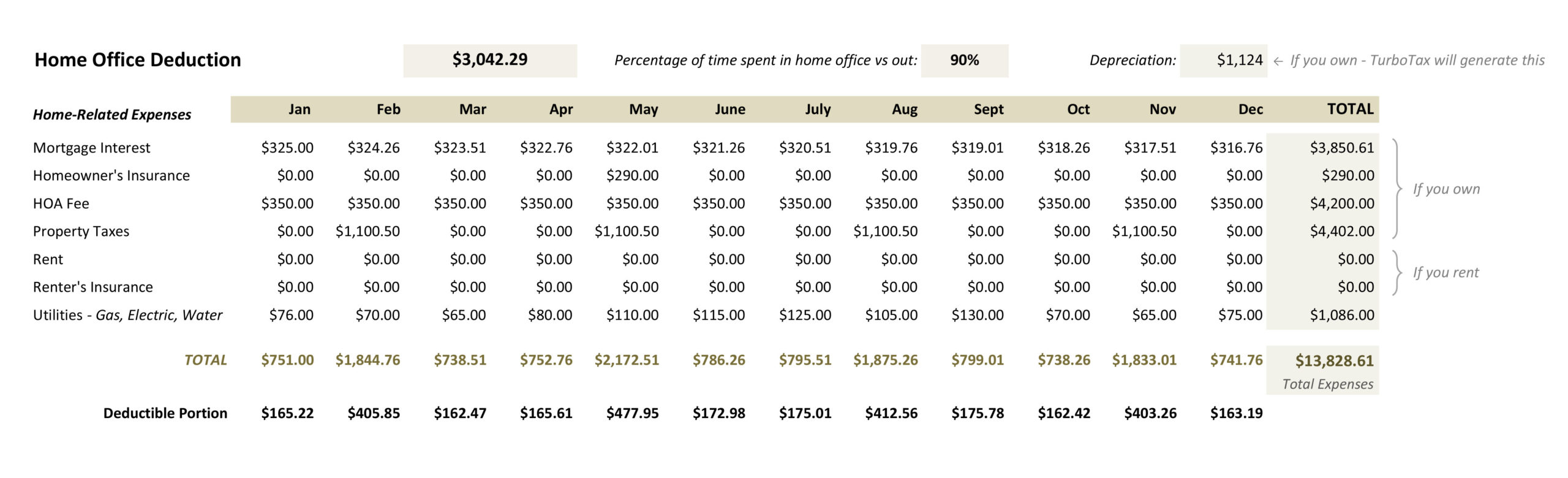

The home office deduction might also provide some relief if you have an office in your home. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. Because hoa fees are not deductible as a state or local tax the new 10000 limitation on state and local income taxes doesnt affect the deductibility of hoa fees.

New for Tax Year 2022 The New Jersey College Affordability Act created three new income tax deductions for taxpayers with gross income under 200000. Year-round residency in your property means HOA fees are not deductible. Are Hoa Fees Tax Deductible Clark Simson Miller Under the proration rules in calculating the deductible amount of its reserve for losses incurred a property or casualty insurance company must reduce the amount of the losses incurred by a specified percentage of.

A few common circumstances are listed below. However if the home is a rental property HOA. This lets you avoid any possible qualms that may arise in the future.

First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15. Homeowners and tenants who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a deduction or a refundable credit when filing an Income Tax return. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense.

As a general rule no fees are not tax-deductible. Your primary residence whether owned. In general homeowners association HOA fees arent deductible on your federal tax return.

Are HOA-fees deductible. An election to file Form 1120 H is done annually before its due date which is the 15 th day of the third month after a tax year. Expenses include mortgage interest as well as many other things like property taxes insurance HOA dues if its a condo maintenance fees rental management.

You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. Are hoa fees tax deductible in nj Thursday March 10 2022 Edit. If the total amount of rented space is 10 then 10 of your hoa fees are tax deductible.

If you live in your property year-round then the HOA fees are not deductible. Are hoa fees tax deductible in nj Tuesday March 8 2022 Edit. For the most part no but there are exceptions.

You may be wondering whether this fee is tax deductible. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. These fees are used to fund the associations maintenance and operations.

The property tax deduction reduces your taxable income. The answer is yes and no. Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees.

So lets go over when an HOA fee is tax deductible and when its not. It regulates the creation voting management and ownership rights of such properties. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences. Yeah we know thats not a great answer but its true. You are eligible for a property tax deduction or a property tax credit only if.

In New Jersey a taxpayer in 2018 can deduct up to 15000 of New Jersey property tax from his or his New Jersey income tax return said Adam Sandler an attorney with Einhorn Harris in Denville. Are HOA Fees Tax Deductible. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense.

Filing your taxes can be financially stressful. Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees. Homeowners associations are allowed a 100 deduction on taxable income and a flat rate of 30 applied.

Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity. But there are some exceptions. However you might not be able to deduct an HOA fee that covers a special assessment for improvements.

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not. However there are special cases as you now know.

However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. All property tax relief program information provided here is based on current law and is subject to change. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas.

To revoke an election requires the consent of IRS. However if HOA fails to file Form 1120. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual. More information is available on the creditdeduction. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

That should make everything a little more clear to you and help keep you out of trouble with the IRS. The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation. Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. There may be exceptions however if you rent the home or have a home office. You can deduct your property taxes paid or 15000 whichever is less.

Unlike a homeowners association a CCMA is not tax-exempt and may not file Form 1120-H U.

100 Manhattan Ave Apt 2117 Union City Nj 07087 Realtor Com

Tax Tips For Homeowners Nj Lenders Corp

What Hoa Costs Are Tax Deductible Aps Management

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

10 Crestmont Rd Apt 7o Montclair Nj 07042 Realtor Com

Closing Costs Tax Deductible How To Discuss

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Are Hoa Fees Tax Deductible Clark Simson Miller

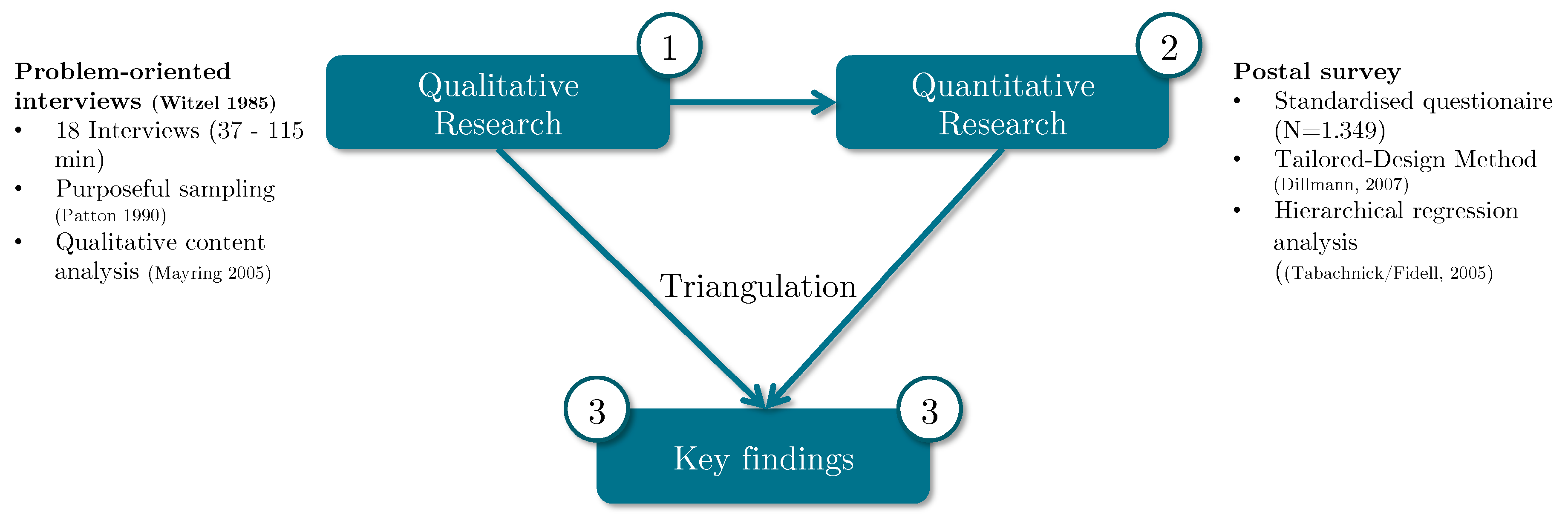

Sustainability Free Full Text Mixed Method Research To Foster Energy Efficiency Investments By Small Private Landlords In Germany Html

Wychwood Gardens Coops Westfield New Jersey Nj Condos Net

Are Hoa Fees Tax Deductible Clark Simson Miller

10 Crestmont Rd 1e Montclair Nj 07042 Mls 21041695 Coldwell Banker

7100 Blvd E Unit 2r Guttenberg Nj 07093 Mls 210020753 Redfin

37 York Dr 1a Edison Nj 08817 Trulia

Are Hoa Fees Tax Deductible Clark Simson Miller

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

Are Hoa Fees Tax Deductible Experian

320 South Street Unit N Morristown Town Nj 07960 6055 Mls 3770290 Trulia